Document management is a crucial aspect of any individual or organization. It involves organizing, storing, and retrieving documents in a way that ensures their security and accessibility. However, with the ever-increasing volume of paperwork and digital files, it can be challenging to determine when to keep or throw away important documents. This article aims to provide insights into the principles of document retention and disposal.

The importance of keeping important documents cannot be overstated. Vital records such as birth certificates, marriage licenses, social security cards, and passports should be kept indefinitely as they are difficult to replace if lost or destroyed. Similarly, financial records such as tax returns, bank statements, investment records, and receipts should be kept for at least seven years for audit purposes. On the other hand, some documents can be safely disposed of once their usefulness has expired. Such documents include outdated insurance policies, expired warranties, old bills and credit card statements, and cancelled checks after three years. Understanding these guidelines helps individuals and organizations avoid clutter while ensuring that they have all the necessary paperwork when needed.

The Importance Of Document Management

Document management is a crucial aspect of any organization, yet it is often overlooked. While some may argue that technology has made paper documents redundant, the truth is that both digital and paper management have their respective advantages and disadvantages. Digital management may be more convenient and cost-efficient, but it also poses risks such as cyber threats and data breaches. On the other hand, paper management may be more tangible and secure, but it can be time-consuming and susceptible to physical damage.

The risks of poor document management cannot be overstated. Mismanaged documents can lead to legal disputes, financial losses, or even reputational damage. For instance, failing to keep track of important contracts or agreements can result in missed opportunities or breached obligations. Likewise, improperly disposing of sensitive information can lead to identity theft or privacy violations. Therefore, document management should not only be seen as an administrative task but also as a strategic function that contributes to the overall success of an organization.

In light of these challenges, it is essential for organizations to develop clear policies and procedures for document retention and disposal. This means defining what types of documents are considered important or confidential, how long they should be kept, who has access to them, and how they should be disposed of once they are no longer needed. By doing so, organizations can minimize risks while maximizing the value of their documents for internal operations or external purposes such as compliance or audits.

Defining Document Retention And Disposal

Document retention and disposal are essential for efficient document management. Digital document retention is the process of storing electronic records according to their lifecycle in an organized manner. On the other hand, paper document disposal involves the destruction of physical documents that are no longer required. It is important to understand when to keep and when to throw away important documents to ensure compliance with legal, regulatory, and business requirements.

To help individuals decide on whether to keep or dispose of a document, here are four things to consider: (1) The importance of the document: If a document contains sensitive information such as personal data or confidential company information, it must be retained for a longer period or disposed of securely. (2) Legal and regulatory requirements: Certain types of documents must be kept for a specific period, such as tax returns or contracts. (3) Operational needs: Documents that are required for day-to-day operations such as invoices or purchase orders should be retained until they are no longer needed. (4) Storage limitations: Storage space can be limited for both digital and paper documents, so it is important to dispose of any documents that have exceeded their retention period.

In summary, digital document retention and paper document disposal are crucial components of efficient document management. Knowing when to keep and when to throw away important documents depends on various factors such as its importance, legal requirements, operational needs, and storage limitations. By understanding these factors, individuals can make informed decisions about how long they need to retain their documents before disposing of them securely.

Moving forward, it is important to consider the legal and regulatory landscape surrounding document retention and disposal. Understanding these regulations will guide individuals on how long certain documents need to be kept before being disposed of securely.

The Legal And Regulatory Landscape

In the previous section, we discussed the importance of defining document retention and disposal. Now we will delve into the legal and regulatory landscape surrounding this process. To illustrate, let’s consider a hypothetical scenario where a company is audited by a regulatory agency. During the audit, it is discovered that the company has not properly retained or disposed of important documents such as customer contracts and financial statements. As a result, the company faces penalties for non-compliance with data privacy and compliance requirements.

Data privacy is a crucial aspect of document retention and disposal. This includes protecting sensitive information like personal identification numbers (PINs), social security numbers (SSNs), and credit card data. Failure to do so can lead to severe legal consequences for organizations. Compliance requirements are also essential in maintaining proper document management practices. Companies must ensure they adhere to all relevant laws and regulations regarding the retention and disposal of important documents.

To prevent scenarios like our hypothetical example from occurring, it is necessary to understand what types of important documents require retention or disposal. There are several categories such as financial records, employment-related documents, customer contracts, business licenses, tax forms, insurance policies, and more. Each category has its unique retention period based on legal requirements or industry standards. Understanding these categories’ nuances ensures that companies retain vital information while disposing of unnecessary documents safely.

Moving forward into our subsequent section about types of important documents that require proper document management practices – financial records play an integral role in any organization’s success.

Types Of Important Documents

Properly organizing and storing important documents can be crucial in ensuring their accessibility when needed. Here are some types of important documents that you should consider keeping:

Legal Documents: These include wills, trusts, power of attorney, and property deeds. Such documents are essential as they help to define ownership and legal rights.

Financial Documents: These include bank statements, tax returns, insurance policies, investment records, and receipts for major purchases. Keeping track of these types of documents can help you with budgeting and financial planning.

Medical Records: These include medical history reports, test results, and immunization records. Such records can be useful for managing ongoing health conditions or when seeking medical attention from a new provider.

Scanning services and safe deposit boxes can be useful tools in managing your important documents. Scanning services allow you to create digital copies that can be stored electronically or on a cloud-based platform accessible from anywhere with an internet connection. Safe deposit boxes provide secure storage options for physical copies of your important documents that may not be easily replaceable.

In summary, proper document management is essential in ensuring the availability of important information when needed. By categorizing your important documents into legal, financial and medical ones and using scanning services or safe deposit boxes where appropriate, you can ensure that they are readily available if the need arises without cluttering up your space unnecessarily. In the next section we’ll discuss vital records such as birth certificates, marriage licenses, social security cards and passports which require special attention in terms of safety measures to protect against identity theft or loss due to natural disasters or other unforeseen circumstances.

Vital Records: Birth Certificates, Marriage Licenses, Social Security Cards, Passports

As the saying goes, “better safe than sorry.” It’s important to keep certain vital records, including birth certificates, marriage licenses, social security cards, and passports. These documents are critical for identification purposes and can be difficult or costly to replace if lost or stolen.

When it comes to other important documents, such as tax returns, bank statements, investment records, and receipts, it’s important to understand when to keep them and when to throw them away. The document replacement process can be time-consuming and tedious, so it’s essential to keep only what is necessary.

One option is to keep digital copies of these documents. This not only helps save physical space but also ensures that you have a backup in case something happens to the original hard copy. However, make sure to store the digital copies securely with proper encryption and backups. By implementing these strategies of document management, you can protect your important records while also freeing up space in your home or office.

| Document Type | Recommended Retention Period | Disposal Method |

|---|---|---|

| Tax Returns | 7 years after filing date | Shred or burn |

| Bank Statements | 1 year (unless needed for tax purposes) | Shred or recycle |

| Investment Records | Until sold + 7 years after sale date | Shred or burn |

| Receipts for Major Purchases | For warranty period + 7 years after purchase date | Store electronically or shred |

In summary, keeping vital records such as birth certificates and passports is crucial. However, it’s important to evaluate which other documents are necessary to keep and which ones can be disposed of safely. By keeping digital copies and following recommended retention periods for financial records such as tax returns and bank statements, you can ensure that your document management system is efficient and effective without cluttering your living space unnecessarily.

Moving forward into financial records: tax returns, bank statements, investment records, and receipts, it’s important to understand their retention periods and disposal methods in order to avoid clutter and protect sensitive information.

Financial Records: Tax Returns, Bank Statements, Investment Records, Receipts

Tax Returns should be kept for at least three years following filing, to enable an audit if necessary. Bank Statements should be kept for at least one year, to allow for the tracking of any suspicious activity. Investment Records should be retained indefinitely, to enable an accurate record of gains and losses. Receipts should be kept for at least one year, to allow for the verification of expenses and tax deductions. Electronic versions of important financial documents should be stored securely and backed up regularly. Paper copies should be kept in a safe, secure location.

Tax Returns

Tax returns are important financial records that individuals and businesses must keep for a certain number of years. These documents contain information about income, deductions, and credits that are used to compute tax liabilities. Keeping tax returns beyond the recommended period can lead to cluttered spaces and disorganized files, but throwing them away too soon can have disastrous consequences when it comes to audits or disputes with the IRS.

Shredding guidelines should be followed when disposing of old tax returns. These guidelines ensure that sensitive information is destroyed properly so that it cannot be accessed by unauthorized persons. For example, shredding documents in a cross-cut pattern rather than a straight line will make it harder for someone to piece together the document. Alternatively, electronic filing can be used as a way to eliminate paper clutter while still keeping important records accessible.

As a document management expert, it is recommended that individuals keep their tax returns for at least three years after the date they were filed or due (whichever is later). However, if there are any red flags such as unreported income or fraud, it may be wise to keep these records for up to seven years. After this time period has passed, individuals can safely dispose of their old tax returns using shredding guidelines or electronic filing methods. By doing so, they will not only declutter their space but also ensure that their sensitive information remains secure.

Bank Statements

Financial records play a crucial role in monitoring one’s financial health. Tax returns are just one of the many documents that individuals and businesses need to keep for a certain period. Another important document that should be retained is bank statements. These documents provide a detailed record of all transactions, including deposits, withdrawals, and transfers. Keeping these records organized and secure can help protect against fraudulent activities.

Bank statement retention guidelines vary depending on the purpose of the document. For personal use, it is recommended to keep bank statements for at least one year, but some experts suggest keeping them for up to seven years if there are red flags or discrepancies. For businesses, the retention period may be longer due to regulatory requirements. Regardless of the reason, it is crucial to dispose of old bank statements properly using secure document disposal methods such as shredding or electronic filing.

Secure document disposal is essential when getting rid of any financial records, including bank statements. Identity theft and fraud are serious concerns that can result from careless handling of sensitive information. Shredding documents in a cross-cut pattern or using electronic filing methods can help ensure that confidential information remains secure even after disposal. By following proper guidelines for bank statement retention and secure document disposal, individuals and businesses can safeguard their financial information and avoid potential risks in the future.

Investment Records

Investment records are another crucial component of financial record-keeping. These documents provide a detailed account of an individual or business’s investment activities, including purchases and sales of stocks, bonds, mutual funds, and other securities. Keeping accurate investment records is necessary not only for monitoring one’s financial health but also for tax purposes.

Tax implications are a significant consideration when it comes to investment records. Capital gains and losses from the sale of investments can have a substantial impact on an individual or business’s tax liability. Accurate investment records can help ensure that taxpayers do not pay more than they owe in taxes or incur penalties for inaccurate reporting.

Organizing tips for investment records include keeping all purchase and sale receipts, trade confirmations, and monthly statements together in one secure location. It is recommended to keep these records indefinitely since the cost basis of investments may be needed years later when selling the asset. By following proper guidelines for retaining and organizing investment records, individuals and businesses can stay on top of their finances while minimizing potential tax liabilities.

Real Estate Records: Deeds, Mortgages, Lease Agreements

Real estate records are essential documents that must be preserved for a long time. Deeds, mortgages, and lease agreements are the three most critical real estate records that should be kept. A deed is a legal document that transfers ownership of a property from one party to another. It is essential to keep the original deed in a safe place as it proves ownership of the property.

Mortgages, on the other hand, are documents that outline the terms and conditions of a loan given to finance the purchase of a property. If you refinance your mortgage, it is crucial to keep all the paperwork related to the refinancing process with your original mortgage documents. This will help you prove that you have paid off your previous mortgage and have secured financing for your current loan.

Lease agreements are binding contracts between landlords and tenants. These documents contain details about rent payment schedules, security deposits, and tenant obligations. It is advisable to keep these documents for at least seven years after they expire as they may come in handy in landlord-tenant disputes.

In summary, preserving real estate records such as deeds, mortgages, and lease agreements is crucial for proving ownership of properties or securing financing for future loans. To add sophistication to this section’s writing style, here are some nested bullet points:

Deeds:

Original copies should be kept in safe deposit boxes.

Digital copies can be stored on cloud-based services.

In case of loss or damage, contact county offices where the property was registered.

Mortgages:

Keep all refinancing paperwork together with original mortgage documents.

Keep track of payment receipts and monthly statements.

Notify mortgage companies immediately if there are changes in mailing addresses or phone numbers.

Lease Agreements:

Store hard copies in folders labeled by date and tenant name.

Take pictures before tenants move-in/out.

Keep records even after expiration dates as they may be helpful in disputes.

Next, we will discuss legal and estate planning documents: wills, trusts, power of attorney, health care directives.

Legal And Estate Planning Documents: Wills, Trusts, Power Of Attorney, Health Care Directives

Real estate records are one of the most important documents that you should keep for a lifetime. These records include deeds, mortgages, and lease agreements. Deeds are legal documents that indicate the ownership of a property. Mortgages are contracts between a lender and borrower to finance the purchase of real estate. Lease agreements outline the terms and conditions under which a tenant is allowed to occupy a property.

Moving onto legal and estate planning documents, these are crucial papers that require careful consideration when it comes to storage. Wills, trusts, power of attorney, and health care directives must be kept safe from damage or loss. Storing wills digitally is now commonly used as an efficient way to store important documents in a secure location online. However, it’s important to remember that these digital copies must be updated regularly.

Updating your estate planning documents is crucial as your circumstances may change over time. It’s also essential to ensure that all beneficiaries named in your will or trust are up-to-date with their information as this can minimize confusion or disputes down the line. Additionally, reviewing and updating power of attorney and healthcare directives can ensure that they reflect your current wishes accurately. By keeping on top of your estate planning documents, you can ensure that your loved ones can carry out your wishes easily without added stress during difficult times.

As we move towards business records such as incorporation documents, contracts, licenses, and permits, it’s essential to understand how long you should keep them for and what format they should be stored in. Incorporation documents are essential for businesses as they establish the entity’s legal existence; therefore, they should be kept indefinitely. Contracts should also be kept for several years after their expiration date or until any possible claims against them have been resolved. Licenses and permits should be kept until renewed or expired; however, it’s recommended to keep copies for at least three years after expiration in case of future disputes or audits by regulatory bodies such as the IRS.

Business Records: Incorporation Documents, Contracts, Licenses, Permits

Business records are essential documents that need to be managed appropriately. These records include incorporation documents, contracts, licenses, and permits. It is important to know when to keep and when to dispose of these types of documents.

Maintaining a clean and organized document management system is critical for any business. However, it can be challenging to store an increasing number of paper documents that accumulate over time. Digitizing documents is an excellent solution that allows you to save space while keeping your important records safe and accessible. You can use cloud storage services or backup techniques such as external hard drives or USB sticks to secure your digital files.

When it comes to contracts and legal agreements, it is best practice to keep the original signed copy for at least seven years after the agreement’s expiration date. However, you may need to retain them longer if there are ongoing legal proceedings related to the contract. Licenses and permits should also be kept on file for at least seven years in case of audits or compliance checks by regulatory agencies.

- Key points for managing business records:

- Determine which records are necessary for legal compliance

- Create a document retention policy based on legal requirements

- Implement a document management system that includes digitization and backup techniques

In summary, incorporating a comprehensive document management strategy ensures that your critical business records remain organized and easily accessible while reducing potential legal risks associated with lost or destroyed documentation. In the next section, we will delve into insurance records: policies, claims, and correspondence – another essential category of records that businesses need to manage carefully.

Insurance Records: Policies, Claims, Correspondence

One of the most important sets of documents to keep track of are insurance records, which include policies, claims, and correspondence. These documents provide evidence of an individual’s coverage and can be used for various purposes such as renewing policies or resolving claim disputes. It is essential to keep these records in a safe and organized manner to avoid any inconvenience.

Renewal reminders are one of the key reasons why it is crucial to retain insurance records. When it comes time to renew a policy, individuals need to know the details of their current coverage to make informed decisions about any changes they may want to make. Having access to previous policies and correspondence can help ensure that there are no gaps in coverage or unexpected surprises when renewing policies.

Claim dispute resolution is another reason why keeping insurance records is vital. In the event of a claim dispute with an insurer, having all relevant documentation at hand can help support a case. Insurance records can also serve as proof of payment or submission in case there are discrepancies or errors in the processing of claims. Overall, keeping insurance records up-to-date and organized is a smart way to protect oneself from potential complications down the line.

| Type | Description | Recommended Retention Period |

|---|---|---|

| Policies | Documents outlining terms and conditions of coverage | Indefinitely |

| Claims | Documentation related to submitted claims | Until resolved + 7 years |

| Correspondence | Communications with insurers regarding coverage or claims | 7 years |

Retaining insurance records serves as an important means for individuals to protect themselves from potential complications related to policy renewal and claim disputes. The recommended retention periods vary depending on the type of record being kept. Policies should be kept indefinitely while claims documentation should be retained until resolved plus seven years. Correspondence should be kept for seven years before disposal. With proper organization and management, individuals can ensure that they have all necessary information at their fingertips when needed most. Next, we will discuss the importance of retaining personal records such as education, employment, military service, and medical records.

Personal Records: Education, Employment, Military Service, Medical Records

Personal Records: Education, Employment, Military Service, Medical Records

Properly managing personal records is crucial for many reasons. Education and employment records are important to have on hand in case of job applications or background checks. Military service records are necessary for accessing benefits and applying for certain government programs. Medical records are essential to maintaining a complete health history and receiving proper medical treatment. It is important to understand how long to keep these documents and when it is safe to dispose of them.

Managing medical documents can be overwhelming, but it is important to keep track of all medical history. The length of time medical records should be kept varies depending on the type of record and the state laws where you reside. Generally speaking, it is recommended that individuals keep medical bills for at least one year after payment, while other medical records should be kept indefinitely. Digital copies of medical records may be stored securely on a hard drive or cloud-based service.

Employment history management is also important as it helps track career progress and provides information for future job searches. Employment contracts, performance reviews, salary information, and tax statements should be kept for at least three years after employment ends. It is also recommended to keep any certifications or training certificates indefinitely as they may be necessary for future job opportunities.

In conclusion, keeping personal records organized and properly disposing of unnecessary documents can help prevent identity theft and provide peace of mind knowing that important documents are easily accessible when needed. In the next section, we will discuss document storage options: paper, digital, cloud-based.

Document Storage Options: Paper, Digital, Cloud-Based

Paper documents remain the most common form of document storage, and their cost, durability, and accessibility make them a viable option for a wide range of applications. Digital documents offer the advantage of improved organization and security through the use of encryption and access control systems. Cloud-based document storage is gaining in popularity due to its ability to facilitate file sharing and provide a reliable backup solution. With ever-increasing regulation and privacy requirements, organizations must consider the legal implications of document storage to ensure compliance. Efficiency is an important factor to consider when selecting a document storage option, as digital documents can be processed more quickly than paper documents. Finally, the environmental impact of document storage options should also be taken into consideration as digital documents often require less physical storage space than paper documents.

Paper

When it comes to document storage options, paper is a popular choice for many individuals and organizations. However, with the advent of digitization benefits, there has been an increasing shift towards digital and cloud-based storage options. Despite this trend, there are still some important documents that need to be kept in hard copy format.

It is important to keep physical copies of documents such as birth certificates, marriage licenses, and wills. These documents are often required for legal purposes and having a physical copy ensures that they are readily available when needed. Additionally, some institutions may require original copies of certain documents before they can be processed.

On the other hand, there are also many documents that can be safely disposed of after being digitized. This not only saves physical storage space but also helps reduce the environmental impact of excessive paper usage. Documents such as bank statements, receipts, and bills can all be scanned and stored digitally. By doing so, they become easily accessible and searchable while also contributing to a more environmentally sustainable approach to document management.

In conclusion, paper remains an integral part of document storage options even in today’s digital age. While some documents need to be kept in hard copy format for legal reasons, others can be digitized for convenience and environmental benefit. As document management experts, it is important to guide clients on when to keep or dispose of important documents based on their individual needs and requirements.

Digital

As document management experts, it is imperative that we keep up with the latest trends and technologies in the field to provide our clients with the best possible solutions. One such trend is digital document storage, which has gained widespread popularity in recent years. Digital storage offers many benefits, including increased accessibility, reduced physical storage space requirements, and enhanced document security.

When it comes to digital document security, backup solutions are crucial. Storing documents on a cloud-based platform or external hard drive ensures that they are safe from physical damage or loss due to unforeseen events like fires, floods, or theft. Additionally, using encryption and other security protocols can further protect sensitive information from cyberattacks and unauthorized access.

Overall, while paper documents still have their place in certain situations, digital document storage should not be overlooked. It offers a wide range of benefits that make managing important documents easier and more efficient for individuals and organizations alike. As document management experts, it is our responsibility to educate our clients on the advantages of digital storage options and help them implement effective strategies for their specific needs.

Cloud-Based

In the world of document management, it is important to weigh the pros and cons of different storage options. One increasingly popular choice in recent years has been cloud-based document storage. This method offers many benefits over traditional paper-based systems and even some digital storage alternatives.

One major advantage of cloud-based document management is the increased accessibility it provides. Documents can be accessed from anywhere with an internet connection, making collaboration and remote work easier than ever before. Additionally, because documents are stored digitally, they take up no physical space, reducing clutter and allowing for more efficient use of office real estate.

Beyond convenience, cloud-based document management also offers enhanced security measures. Encrypted data and password-protected access can help protect sensitive information from unauthorized access or data breaches. Furthermore, because documents are stored remotely on secure servers, they are safe from physical damage or loss due to unforeseen events like natural disasters or theft.

Overall, whether you are a business owner looking to streamline operations or an individual hoping to better organize personal documents, cloud-based document management offers a range of benefits that cannot be ignored. By considering this option alongside other storage alternatives, you can make an informed decision that meets your unique needs while keeping your important documents safe and accessible at all times.

Best Practices For Organizing And Protecting Documents

Effective document management is essential for any individual or organization. A well-organized and protected set of documents can help save time, reduce stress, and improve productivity. One of the best practices for organizing and protecting documents is digitizing them. Digitizing documents involves converting paper-based records into electronic files that can be stored in a secure location accessible from anywhere.

Another crucial aspect of document management is labeling documents properly. Labels help identify critical documents and make it easier to retrieve them when needed. Proper labeling should include essential information such as document type, date created, author name, and keywords related to the content of the document. It is also crucial to use consistent labeling across all documents to avoid confusion when searching for specific files.

Incorporating these best practices will help individuals and organizations maintain a well-organized and protected set of documents. As we move towards a more digital world, it is essential to embrace these practices to avoid cluttered physical spaces and improve access to important information. In the subsequent section, we will discuss how outdated policies, expired warranties, old bills, canceled checks, among other things are examples of when it becomes necessary to dispose of certain types of documentation without impacting the overall effectiveness of your document management system.

When To Dispose Of Documents: Outdated Policies, Expired Warranties, Old Bills, Cancelled Checks

Following the best practices in organizing and protecting documents, it is important to know when to dispose of outdated documents. Outdated policies, expired warranties, old bills, and cancelled checks are examples of documents that should be discarded properly. Keeping these types of documents beyond their usefulness can lead to clutter and pose a risk for identity theft.

Expired passports and old insurance policies are also documents that should be disposed of properly. These types of documents contain personal information that can be used for fraudulent activities if they fall into the wrong hands. Expired passports can be shredded or cut into small pieces before disposal, while old insurance policies can be returned to the issuing company or shredded as well.

Document management experts recommend following a retention schedule when determining how long to keep important documents. This schedule varies depending on the type of document, but generally ranges from one year for utility bills to seven years for tax-related records. After this time period has passed, it is safe to dispose of the document properly by shredding or using other document disposal methods.

Bullet Point List:

- Properly disposing of outdated documents reduces clutter

- Discarding expired passports and old insurance policies protects against identity theft

- Following a retention schedule ensures proper document management

- Document shredding and disposal methods should comply with legal requirements

As an expert in document management, it is important to advise clients on when to dispose of outdated documents properly. By following a retention schedule and incorporating appropriate document shredding and disposal methods, individuals can ensure that their personal information remains secure while minimizing clutter in their living spaces. It is crucial to emphasize that proper disposal methods must comply with legal requirements to avoid any potential legal repercussions.

Document Shredding And Disposal Methods

When it comes to managing important documents, the task doesn’t end with keeping them organized and secure. Proper disposal of these documents is equally crucial to prevent identity theft and maintain confidentiality. While some may argue that throwing away papers in the trash can suffice, this is far from true. Documents require proper shredding techniques and disposal regulations to ensure they are irretrievable.

Shredding techniques vary depending on the type of document, but cross-cut shredders are considered the most effective. These machines cut paper into tiny pieces, making it impossible for anyone to piece them back together. It is also recommended to shred credit cards, CDs, and DVDs as these items contain sensitive information that can be easily retrieved if not properly disposed of.

Disposal regulations must also be followed when getting rid of important documents. Different states have different laws regarding document retention periods and disposal methods. Knowing these regulations will help individuals avoid legal repercussions and ensure compliance with government standards. Some companies offer professional shredding services that adhere to these regulations and provide a certificate of destruction once the job is done.

Proper document shredding and disposal is an essential part of maintaining confidentiality while minimizing security risks. By using effective shredding techniques such as cross-cutting and following disposal regulations set by governing bodies, individuals can rest assured they are doing their part in protecting sensitive information. Remember, taking care of important documents isn’t just about keeping them safe while in use – it’s about ensuring they remain secure even after their usefulness has come to an end.

Conclusion

The proper management of important documents is a crucial aspect of our daily lives. As document management experts, it is our responsibility to educate ourselves and others on the importance of document retention and disposal. By understanding the legal and regulatory landscape surrounding document management, we can ensure that we are keeping the right documents for the appropriate amount of time.

It is important to keep vital records such as birth certificates, marriage licenses, social security cards, and passports in a safe place. These documents should be stored in a secure location, either in paper form or digitally. Best practices for organizing and protecting documents include creating an inventory of all important documents, utilizing password protection for digital files, and regularly backing up electronic files.

As time passes, certain documents become outdated or no longer necessary. Old bills and cancelled checks can be disposed of after a certain period of time has passed. Expired warranties and outdated policies should also be discarded once they are no longer relevant. Proper disposal methods such as shredding can help protect sensitive information from falling into the wrong hands.

In conclusion, managing important documents is an essential part of our lives that cannot be overlooked. By understanding the legal requirements surrounding document retention and disposal, we can create a system that works best for us while also ensuring that our information remains secure. As document management experts, it is our duty to provide guidance on best practices for organizing and protecting these documents so that they remain accessible when needed but also safeguarded against potential threats. By doing so, we can have peace of mind knowing that our sensitive information is being handled with care.

Image Credits

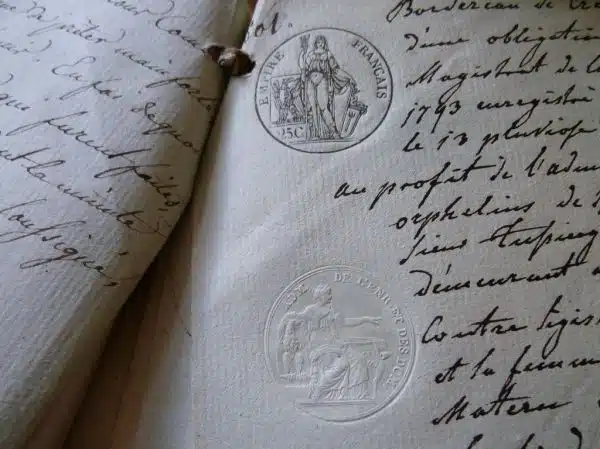

- “Old document with nice stamp” by storebukkebruse (featured)